Any company requires precise and current financial records in today’s fast-paced business world. Many U.S. firms, especially SMEs, find accounting time-consuming, expensive, and error-prone. This article discusses the finest accounting services for firms in the U.S. It will also discuss outsourcing’s benefits and why more organizations are using outsource bookkeeping services in the U.S. Lastly, you will also get to know vital things to keep in factors to consider while choosing a service provider and the available options.

Top Outsource Bookkeeping Service Provider for U.S. Companies

Based on some common factors, the following are some of the best firms for accounting outsourcing in USA:

- Bench Accounting

Bench is a well-known online banking service designed to meet small businesses’ needs. They take a simple bookkeeping method and give each client a dedicated bookkeeper.

Bench handles your monthly taxes, books, and financial reports. As part of their service, they make income records and balance sheets and also balance bank and credit card accounts.

When it comes to technology, Bench uses its software that works with major banks to sync data and make changes in real-time. Bench has great customer service; you can talk to your bookkeeper by phone, email, or chat. The pricing is clear and depends on the size and complexity of your business.

- Bookkeeper360

The full-service accounting firm Bookkeeper360 handles taxes, outsourced bookkeeping, and CFO consultations. They work with companies of all kinds, from new ones just starting to big ones that have been around for a while. Bookkeeper360 does more than just regular bookkeeping. They also handle cash flow, make budgets, and predict the future of your finances. They also offer CPA services for tax planning and filing.

The company uses Xero financial software, which is known for being easy to use and having a lot of useful features. They work with business tools like Shopify and Gusto as well.

Customers can get help from Bookkeeper360’s specialized accounting teams, who can be reached by phone, email, or their online portal. Their prices are flexible, so you can choose between hourly billing or set monthly plans based on what services you need.

- Pilot

- Pilot is a bookkeeping service for new and growing companies. They use human knowledge and technology to ensure their financial services are accurate and on time.

The pilot does full-service outsource bookkeeping, which includes putting deals into categories, doing reconciliations, and giving you financial reports. They can also help with R&D tax credits and act as your CFO.

Pilot works with well-known accounting programs like QuickBooks and Gusto, making sure that tracking goes smoothly and quickly. Every customer is given a personal account manager who helps and guides them. Pilot’s price is based on your monthly costs, making it a good choice for growing businesses.

- inDinero

inDinero provides a wide range of financial services, such as accounting, budgeting, tax planning, and CFO services. With a focus on tech-driven solutions, they work with companies and small businesses. As part of their accounting services, they sort transactions into categories, reconcile bank accounts, make financial reports, and keep track of your budget.

They also help people file and follow the rules for taxes. inDinero uses cloud-based accounting software that works with many other business tools to give them real-time financial information and insights.

inDinero provides personalized help to a group of accountants and CPAs who can answer questions and advice on moving forward. Each client’s services set their prices, and their deals can be changed to fit those needs.

- KPMG Spark

- KPMG Spark is an online financial service offered by KPMG, which is one of the “Big Four” accounting firms. They provide both automated bookkeeping and accounting services that professionals do, including full-service accounting, tax preparation, and real-time payroll from KPMG Spark.

On top of that, they offer advanced financial reporting and control of cash flow. When it comes to technology, KPMG Spark has a platform that works with big accounting software and banks to give real-time data and insights.

Bookkeepers, accountants, and tax consultants from KPMG assist clients. KPMG Spark’s subscription pricing depends on service level and business size.

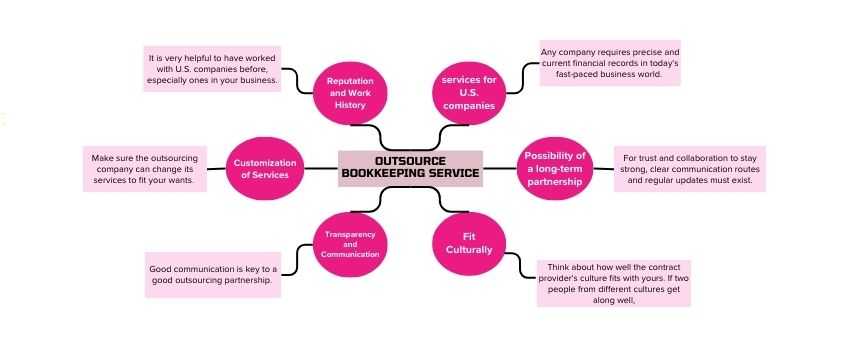

Choosing the Right Outsourcing Partner

It’s important to choose the right outsourcing partner. U.S. companies should think about the following when looking at possible providers:

- Reputation and Work History: Look into the provider’s history by reading reviews and case studies from past clients. It is very helpful to have worked with U.S. companies before, especially ones in your business.

- Customization of Services: Make sure the outsourcing company can change its services to fit your wants. The provider should be able to offer a solution that fits your business goals, whether you need simple outsourced bookkeeping or more in-depth financial management.

- Transparency and Communication: Good communication is key to a good outsourcing partnership. Pick a service company that emphasizes being open about pricing, providing services, and reporting. For trust and collaboration to stay strong, clear communication routes and regular updates must exist.

- Fit Culturally: Think about how well the contract provider’s culture fits with yours. If two people from different cultures get along well, they may be able to better understand your business goals and work together to make it happen.

- Possibility of a long-term partnership: Saving money is important, but thinking about how the connection could work in the long run is also important. A good partner for the success of your business will be a service provider that can adapt to your needs and offer more advanced services as they arise.

Conclusion

U.S. companies that want to improve their finances, cut costs, and get access to knowledge and technology should outsource their outsource bookkeeping services. Accounting outsourcing in USA has benefits beyond just saving money. It can also improve accuracy, compliance, and scale, which can help a business grow.